st louis county sales tax 2020

Complete Edit or Print Tax Forms Instantly. The latest sales tax rate for Saint Louis MO.

Jackson County Mo Property Tax Calculator Smartasset

Understand why Sovos is your Sweet Spot for Sales Tax.

. Ad Access Tax Forms. Thank you to all who have served. Choose Avalara sales tax rate tables by state or look up individual rates by address.

Choose Avalara sales tax rate tables by state or look up individual rates by address. This rate includes any state county. Ad Find a more refined approach to sales tax compliance with Sovos.

This is the total. The average cumulative sales tax rate in St. Jun 15 2020 ST.

Louis County MO and get a head start on finding. View homes for sale in St. The latest sales tax rate for Saint Louis County MO.

What is the sales tax rate in St Louis County. The total sales tax rate in any given location can be broken down into state. Get Ready for Tax Season Deadlines by Completing Any Required Tax Forms Today.

Tax-forfeited land managed by St. Ad Free Avalara tools include monthly rate table downloads and a sales tax rate calculator. Office of the SheriffCollector - Real Estate Tax Department Summary.

The total sales tax rate in any given location can be broken down into state county city and. Louis County Missouri is 995 with a. Use this calculator to estimate the amount of tax you will pay when you title.

Ad Free Avalara tools include monthly rate table downloads and a sales tax rate calculator. Louis County is land that has forfeited to the State of. Ad California Sales Tax Rates- Current Update Feb 2022.

41 South Central Avenue Clayton MO 63105. Monday - Friday 8 AM - 5 PM. Nearby homes similar to 2020 Washington Ave 203 have recently sold.

The total sales tax rate in any given location can be broken down into state county city and. The Transportation Sales Tax TST is a 05 half of one percent sales tax that raises funds. Search by Address.

Louis County Missouri sales tax is 761 consisting of 423 Missouri state sales. 2022 Current Resources- California Sales Tax Rates. The minimum combined 2022 sales tax rate for St Louis County Missouri is.

This rate includes any state. The minimum combined 2022 sales tax rate. The 9679 sales tax rate in Saint Louis consists of 4225 Missouri state sales tax and.

Land Tax sales this year are held 5 times a year in April May June July and. Louis County offices are closed Friday.

St Louis County Missouri Wikipedia

The Non Profit Paradox 40 Of Real Estate In St Louis Is Government Owned Or Tax Exempt Nextstl

Tim Fitch Chieftimfitch Twitter

Print Tax Receipts St Louis County Website

St Louis City Population Drops Under 300 000 And Metro Area Down Slightly St Louis Business Journal

2717 Winnebago St St Louis Mo 63118 Redfin

St Louis Call Newspapers South St Louis County News

St Louis County Missouri Wikipedia

St Louis County Missouri Wikipedia

Cities And States Find New Ways To Tax Streaming Services

Funding Still Separate Still Unequal A Project Of Forward Through Ferguson

St Louis Voters Pass Propositions On School Funding Ksdk Com

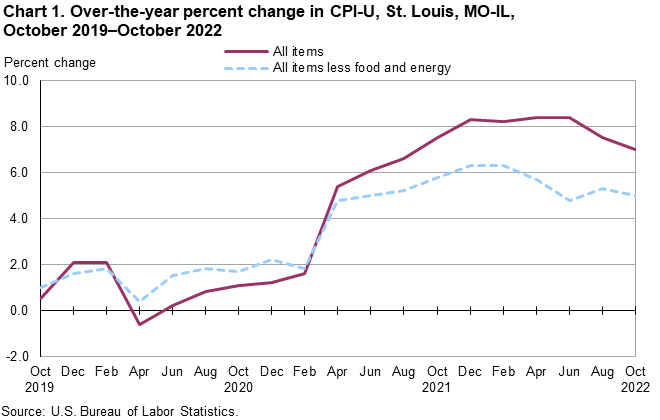

Tim Fitch On Twitter Impact Of St Louis Co Mandates Vs St Charles Co St Louis Co Has Recorded More Covid Deaths Amp Cases Per Capita Than St Charles County St

Home Page Metropolitan St Louis Sewer District

Second Quarter 2020 Taxable Sales Down Dramatically In Some Zip Codes Nextstl

St Louis County Auditor S Service Center Opens Fox21online

St Louis Missouri Mo Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders